Vatsal Shah

Certified ScrumMaster® | Agile Technical Project Manager

Generative AI in Finance: Revolutionizing Fintech and Trading

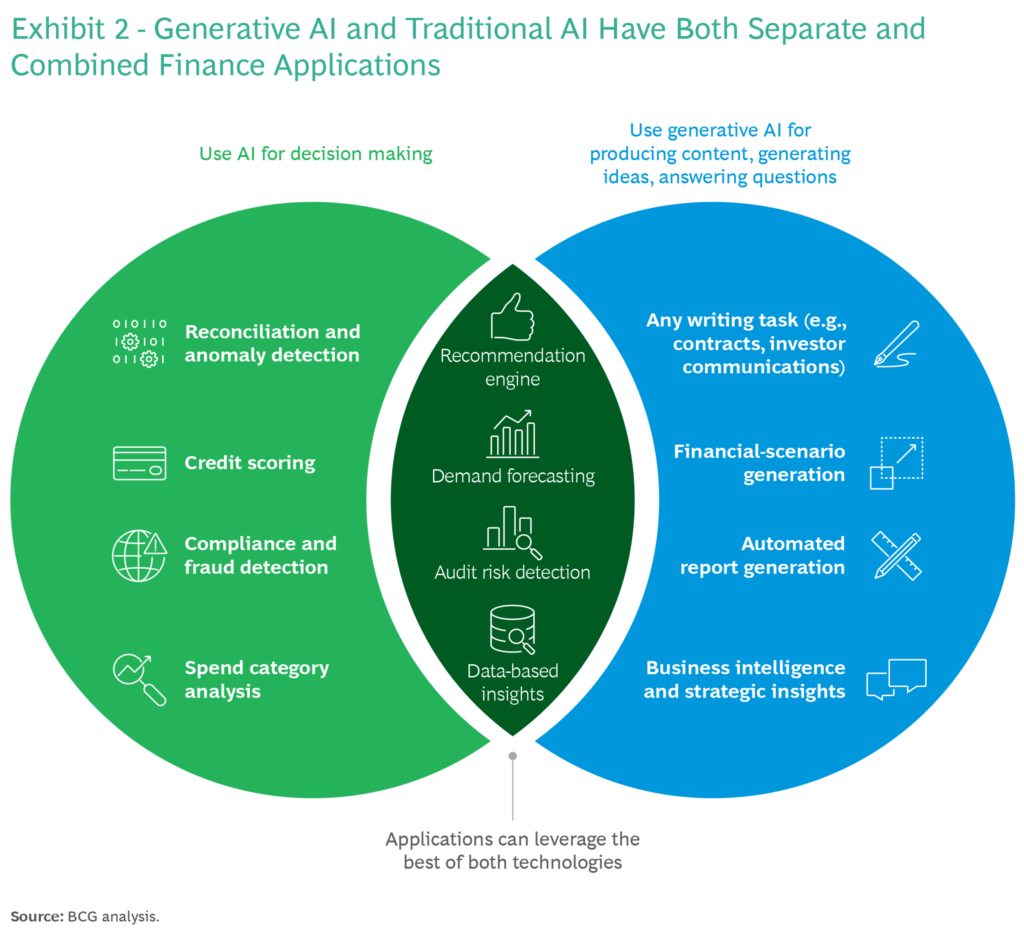

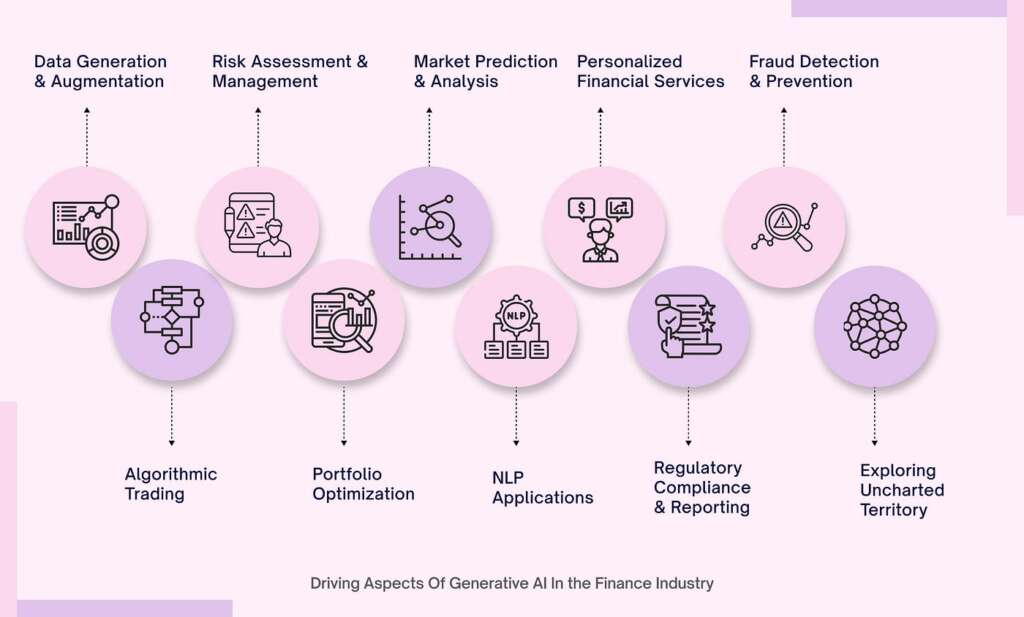

The financial landscape is undergoing a paradigm shift, driven by the transformative power of artificial intelligence (AI). Among the most exciting advancements is generative AI, a branch of AI capable of creating entirely new data, not just analyzing existing information. This technology holds immense potential to revolutionize the way we approach fintech and trading, unlocking a future of enhanced efficiency, personalized experiences, and data-driven decision-making.

Imagine a world where:

- Fintech platforms can personalize financial advice and product recommendations based on your unique financial goals, risk tolerance, and spending habits.

- Fraudulent activities are identified and thwarted in real-time, thanks to AI’s ability to generate synthetic data and identify anomalies.

- Algorithmic trading strategies become even more sophisticated, leveraging generative AI to analyze vast datasets and uncover hidden patterns that traditional models miss.

This is not just a futuristic vision; it’s the reality that generative AI is actively shaping. Let’s delve deeper into the specific applications of this technology in the realm of finance:

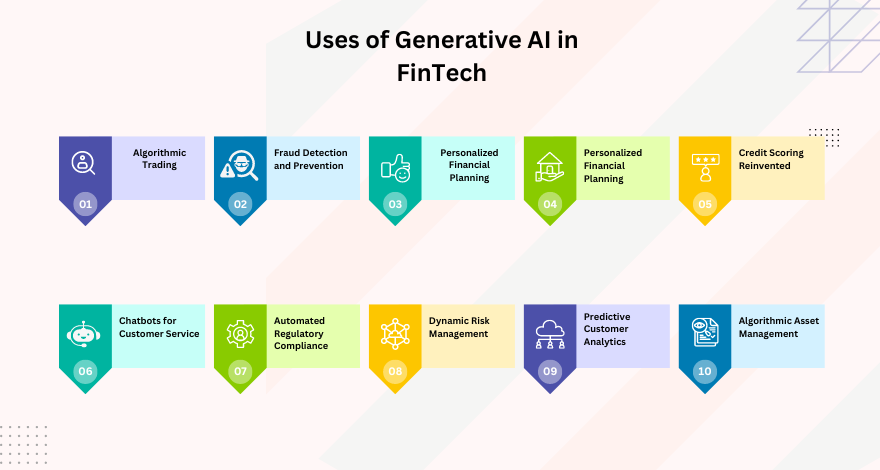

1. Personalized Financial Services:

Generative AI can personalize financial experiences by:

- Generating custom financial reports and insights: AI can analyze your financial data and generate reports tailored to your specific needs, helping you understand your spending patterns, track progress towards goals, and make informed decisions.

- Recommending personalized financial products: By understanding your financial situation and risk tolerance, AI can recommend suitable investment options, insurance plans, and other financial products that align with your individual goals.

- Providing interactive financial guidance: Chatbots powered by generative AI can answer your financial questions, offer personalized advice, and even guide you through complex financial processes.

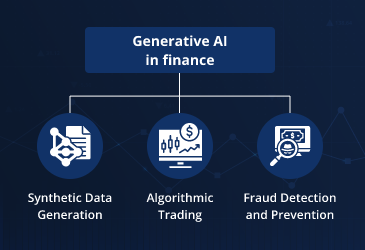

2. Enhanced Fraud Detection:

Generative AI can significantly improve fraud detection by:

- Generating synthetic data: This data can be used to train AI models to identify fraudulent patterns more effectively, even in situations where real-world data is limited.

- Simulating real-world scenarios: AI can generate different fraud scenarios to test the robustness of existing security measures and identify potential vulnerabilities.

- Detecting anomalies in real-time: By continuously analyzing financial transactions, AI can identify suspicious activities and flag them for further investigation, preventing financial losses.

3. Revolutionizing Algorithmic Trading:

Generative AI can transform algorithmic trading by:

- Identifying hidden market patterns: AI can analyze vast amounts of historical and real-time data, including news, social media sentiment, and economic indicators, to uncover hidden patterns that traditional models might miss.

- Generating new trading strategies: AI can use its ability to create new data to explore different trading scenarios and develop more effective trading strategies.

- Optimizing existing strategies: AI can continuously analyze the performance of existing trading strategies and suggest adjustments to improve their effectiveness.

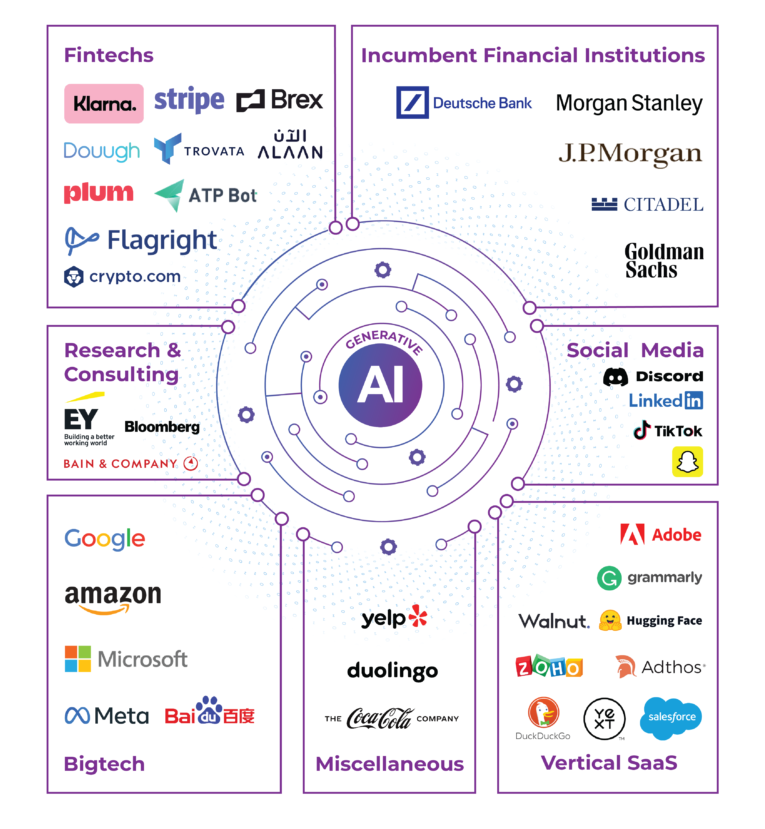

The potential of generative AI in finance is vast and far-reaching. As this technology continues to evolve, we can expect to see even more innovative applications emerge, transforming the way we manage our finances, interact with financial institutions, and navigate the ever-changing financial landscape.

However, it’s crucial to acknowledge the ethical considerations surrounding generative AI. Biases in training data can lead to discriminatory outcomes, and the potential misuse of this technology for malicious purposes needs to be addressed. As we move forward, it’s essential to ensure responsible development and deployment of generative AI in finance, prioritizing transparency, fairness, and accountability.

Generative AI is not just a technological marvel; it’s an opportunity to create a more inclusive, efficient, and data-driven financial future for everyone. By embracing this technology responsibly and thoughtfully, we can unlock its full potential to empower individuals and reshape the financial landscape for the better.